Our Blog

Expert Insights for Homebuyers and Sellers

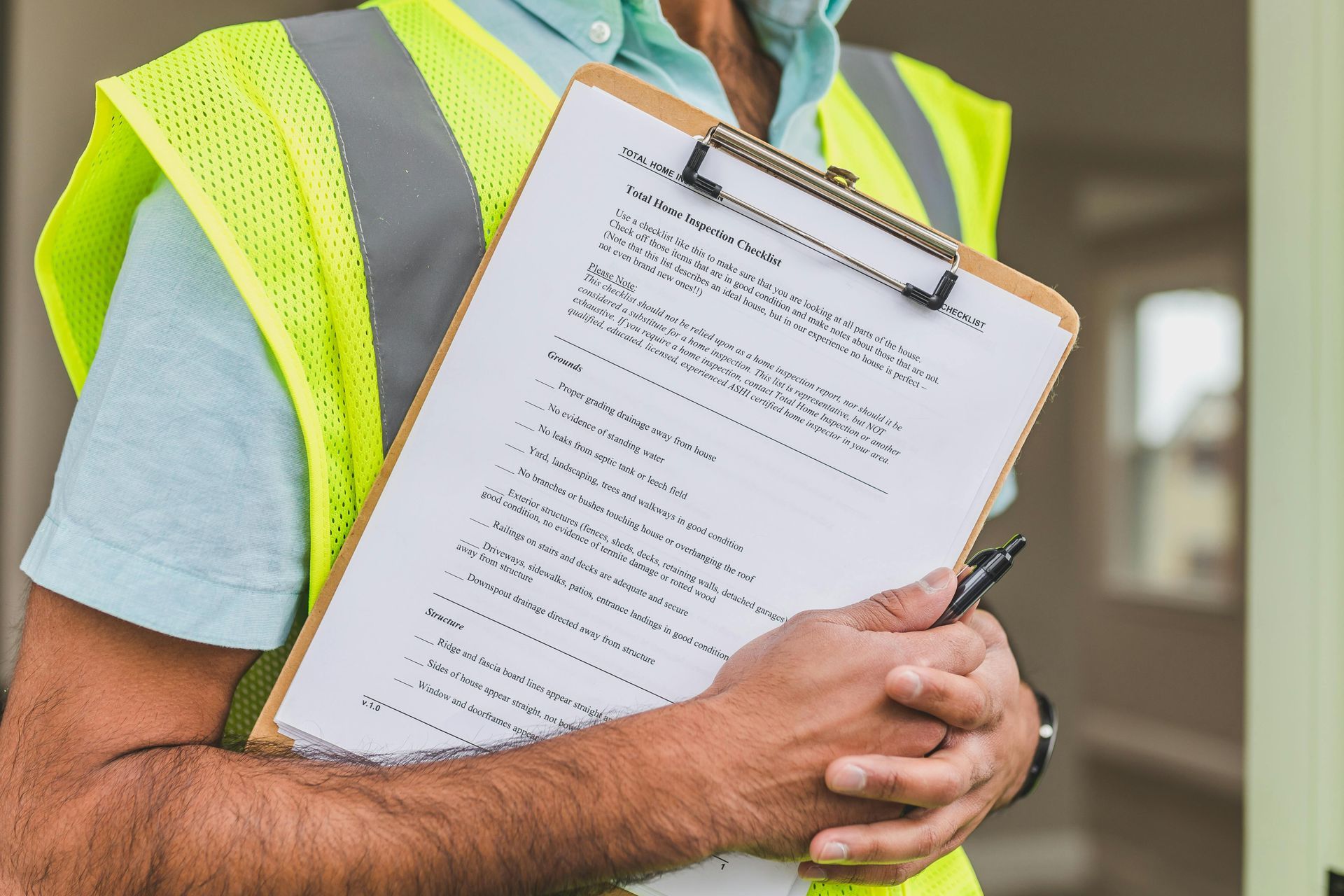

Welcome to the True Blue Home Inspections Blog! Stay informed with engaging, keyword-focused articles designed to help you navigate the home inspection process with confidence. From tips for buyers and sellers to insights on air quality and property safety, our blog is your go-to resource for everything home inspection-related.

Below, you’ll find links to our blog categories. Each category contains a collection of articles tailored to specific aspects of home inspections, updated regularly to keep you informed.